Analysis

Marco Olivera

Why has gold reached a historical price during the pandemic time?

- Investors have made purchases of this metal to protect themselves to the fears generated by the world economic recession.

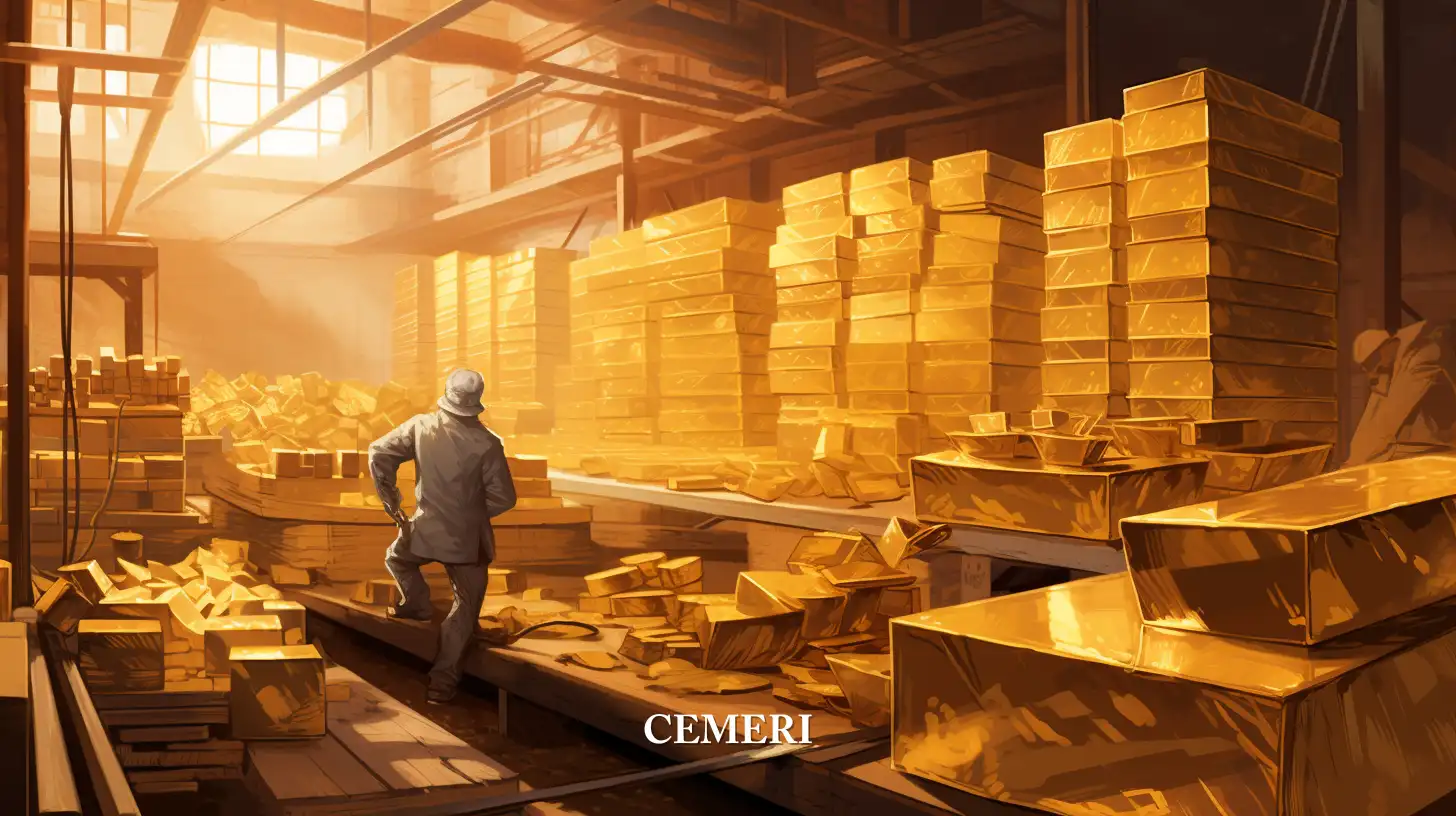

October 17, 2012 was the last time that gold reached a price similar to these days when it reached 1,743.0 dollars per ounce. Investors have made purchases of this metal to protect themselves to the fears generated by the global economic recession -applying by the pandemic, causing the disruption of productive chains and contracting the world economy -and by the series of fiscal and monetary measures opted by Some central banks in the world.

Why has gold reached a historical price during the pandemic time?

On April 14, 2020, the gold price reached $ 1.741.20 per ounce. Since the end of December 2019, its price began to increase considerably.

There are other economic factors such as crises and assets of assets (eg the dollar) that influence the price of gold, but also do international phenomena; Economists and financial have badly called to this influence as "geopolitical risk", defined as »The Probability That An Investment's Profitability Will Suffer Due to Circumstances Related To Unexpeted Changes Involve POLITICAL REVOLUTIONS, Coups, Elections, Ethnic Conflicts, Dispute In The Sand In The Sand International Policy, Property Rights, and A Number of Similar Factors ».

The probability that the profitability of an investment will be affected due to circumstances related to unexpected changes that involve political revolutions, coups, elections, ethnic conflicts, disputes in the field of national or international policy, property rights and a series of similar factors. 1

This situation is used by governments and investors to increase their reservations and protect them. In the past, the increase in the gold price coincided with the appearance of various international phenomena. However, before other phenomena prices have been maintained or lowered.

Is it recommended to store gold before international phenomena?

Meng Qin et al. 2 suggest taking into account economic factors and understanding the interaction between geopolitical risks »and the price of gold to predict its trend and make the best decision.

Sources

1Bruno, Alessando. (2019). Whats is a geopolitical risk and how does it influence the markets?. Midas Letter. Recuperado de https://midasletter.com/2019/09/what-is-geopolitical-risk-and-how-does-it-influence-the-markets/

2Meng Qin, Chi-Wei Su, Xin-Zhou Qi y Lin-Na Hao. (2019). Should gold be stored in chaotic eras?. Economic Research-Ekonomska Istraživanja, Vol. 33, pp.224-242. Recuperado de https://www.tandfonline.com/doi/full/10.1080/1331677X.2019.1661789