Map

Luis Salgado

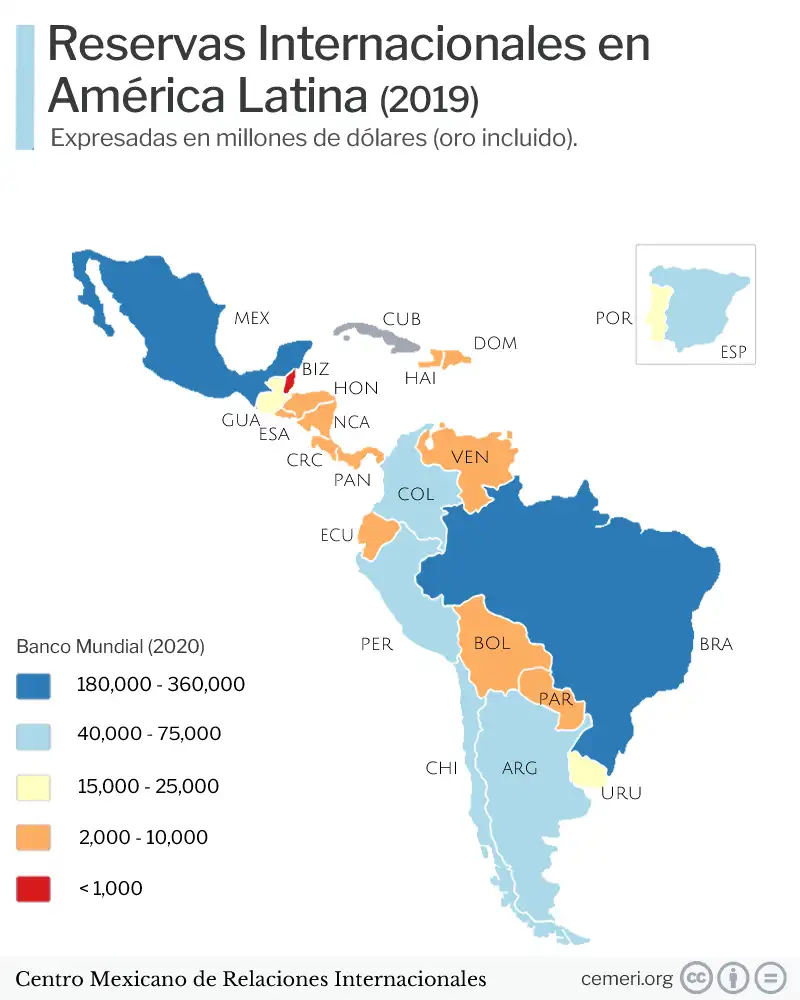

International Reserves in Latin America

- In Latin America, Brazil and Mexico are the countries with the largest international reserves in the region.

International reserves are assets held by a central bank. These reserves are used to support liabilities and influence the country's monetary policy. In Latin America, Brazil and Mexico are the countries with the largest international reserves in the area. Likewise, both countries are within the world top 15, which is led by China.

Regarding international reserves, there are 3 key elements that must be rescued:

• These may include foreign currencies, bonds, treasury bills, and other government securities.

• Economists suggest that it is better to hold foreign exchange reserves in a currency that is not directly related to the country's currency.

• Most foreign exchange reserves are held in US dollars, with China being the largest holder of foreign exchange reserves in the world with reserves exceeding the value of [3 trillion dollars](https://www.forbes.com/ sites/salvatorebabones/2018/05/24/china-is-sitting-on-3-trillion-in-currency-reserves-but-is-that-enough/?sh=42b027375fce).

How do international reservations work?

While these assets serve many purposes, the main use for them is to ensure that the central government has fallback funds in case its national currency rapidly devalues or becomes completely insolvent. For example, when there is a depreciation of the local currency against the dollar, dollars from the reserve are usually auctioned or injected into the market to prevent the currency from continuing to lose value.

This is a common practice in countries around the world. Most of these reserves are held in US dollars, as it is the most traded currency in the world. It is not uncommon for international reserves to also be made up of the British pound (GBP), the euro (EUR), the Chinese yuan (CNY) or the Japanese yen (JPY).

In addition to China, there are only 2 States with reserves of more than a trillion dollars: Japan and Switzerland. Meanwhile, in the Latin American region the average is only 40 billion dollars. Brazil being the country with the largest number of reserves (360 million dollars) and Belize the one with the lowest with just 280 million.

Although the practice is to establish reserves with foreign currencies, a large number of countries have opted to do so with gold. Russia's international reserves are held mainly in US dollars, just like the rest of the world, but the country also holds some of its reserves in gold. Since gold is a commodity with underlying value, the risk of relying on gold in the event of a Russian economic downturn is that the value of gold will not be significant enough to meet the country's needs.

As of today, the United States is the state with the largest number of gold reserves with [a total of](http://www.usfunds.com/investor-library/frank-talk/top-10-countries-with -largest-gold-reserves/#.X7qIQhb9ZPY) 8 thousand tons. Followed by Germany with 3,000 and Italy with 2,400.

Sources

Banco Mundial (2020)