Map

Luis Salgado

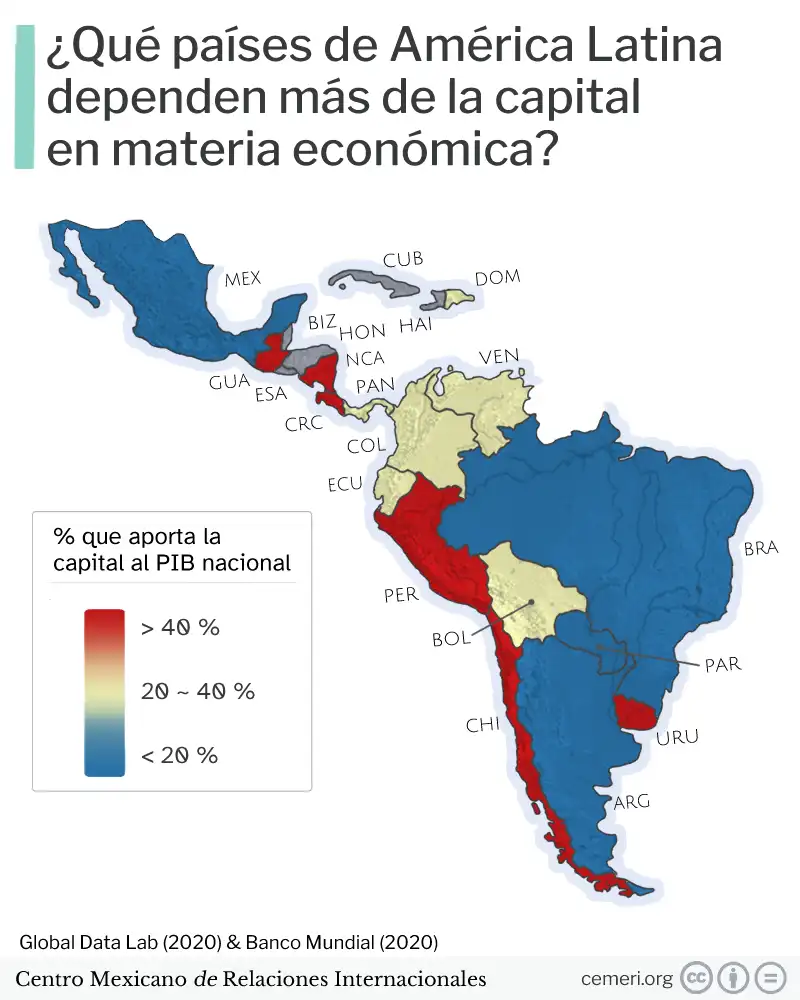

Economic dependence of Latin American countries on the capital

- Speaking about economic dependence in International Relations is often associated with trade ties.

Talking about economic dependence in International Relations is usually associated with existing commercial ties between countries. For example, it is a well-known fact that Mexico exports a large part of its goods to the United States. In 2018 alone, 80% of everything produced in the country was exported to its neighbor to the north. Such a lack of diversity brings with it a degree of dependency that, while it could be beneficial, is actually more likely to backfire. This is what the annals of 2008 and 2009 point out, when Mexico faced its worst economic crisis in 70 years.

To a certain extent, the situation was aggravated by the international crisis in which a large part of the international community was immersed. However, the reason behind such a bloody scenario lies in Mexico's extensive dependence on the United States. Given this, diversification is always a good tool to anticipate and manage to deal with adverse economic situations. Such a rule works the same for business partners as for domestic economic foci. In other words, countries that obtain a large part of their GDP from their capital city are exposed to an endless number of possible catastrophic scenarios.

For example, Lima contributes close to 45% of Peru's total GDP. This means that in the event that a natural disaster interrupts the operations of said city, the entire country would suffer the consequences of such an event that could well seem “isolated”. The scenario is very different for other countries such as Chile, Venezuela and Uruguay.

The adverse effects do not lie solely in the country's vulnerability to unpredictable events, but another problem derived from such a degree of dependency lies in the centralization of resources and development. When there is a clear economic focus within the countries, this generates a magnet effect of migration and capital attraction that ends up generating high levels of inequality. It is no surprise that in many countries the capitals enjoy a high degree of infrastructure and development, while at the same time highly marginal regions coexist. For example, the average salary in Moscow is around $1,100 dollars, a figure that is reduced to $100 when moving to the regions furthest away from the capital. Certainly, the dangers of a high degree of dependency are real and have already been glimpsed by different countries. A clear example of this is China, which has developed a plan for special economic zones (SEZs) with the aim of creating a distribution of economic development.

Degree of dependency in Latin America with respect to the capital of each country

| Country | Capital | % to GDP |

|---|---|---|

| Brazil | Brasilia | 3.6 |

| Paraguayan | Asuncion | 15.59 |

| Mexico | CD. From Mexico | 16.4 |

| Argentinian | Buenos Aires | 19.1 |

| Ecuador | Quito | 22.11 |

| Colombia | Bogota | 25.8 |

| Panama | CD. Of Panama | 26.2 |

| Bolivian | The Peace | 28.5 |

| Dominican Republic | Santo Domingo | 34 |

| Venezuela | Caracas | 37 |

| Chile | Santiago | 42 |

| Costa Rica | San Jose | 45 |

| Peru | Lime | 45.8 |

| Guatemala | CD. From Guatemala | 46.76 |

| Nicaraguan | Managua | 48 |

| Uruguay | Montevideo | 49.1 |

| Belize | Belmopan | s/d |

| Cuba | Havana | s/d |

| El Salvador | San Salvador | s/d |

| Haiti | Port au Prince | s/d |

| Honduras | Tegucigalpa | s/d |

Sources

Global Data Lab (2020) Consultado el 28 de marzo de 2021 en https://globaldatalab.org/

Banco Mundial (2020) Consultado el 27 de marzo de 2021 en https://datos.bancomundial.org/indicador/NY.GDP.MKTP.CD