Encyclopedia

Marco Olivera

What are commodities?

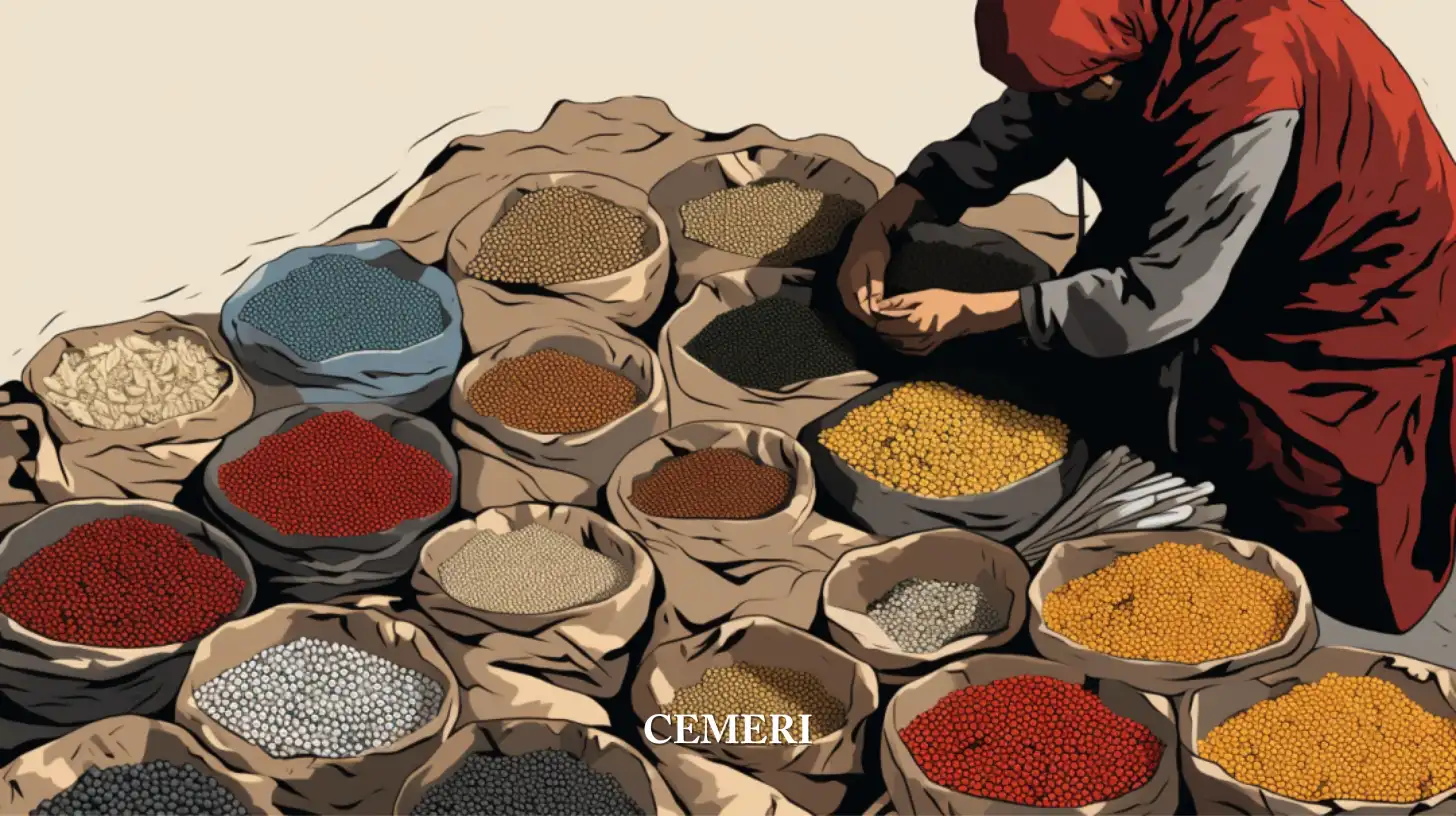

- Traditional examples of commodities include grains, gold, beef, sugar, oil, and natural gas.

A commodity or raw material is a basic good used in trade that is interchangeable with other goods of the same type, and these are often used as inputs in the production of other goods and services.

Traditional examples of commodities include grains, gold, beef, sugar, oil, and natural gas. They form the basis of our economy, because they are necessary for the production of food, energy and clothing, and they affect the prices of the same food, clothing, gasoline, the price of transportation, jewelry, etc.

Commodities are often mass-produced and standardized in quality and quantity, meaning they are priced the same regardless of who produced them.

Types of commodities

1. hard commodities

These are natural resources that are extracted from the earth, such as gold, silver, oil, copper, and natural gas.

2. soft commodities

These commodities are grown and harvested, such as coffee, wheat, and timber, or raised, such as cattle, pigs, etc.

Also, they can be classified more specifically to account for their different purposes or the processes that are involved in their production. These categories include:

- Agriculture: basic products grown for human consumption, for the manufacture of clothing and construction materials. Among some of the most important for its commercialization are corn, soybeans, oats, barley, wheat, sugar, cocoa, rice, cotton and coffee.

In general, the price and availability of these commodities are subject to weather, natural disasters, and disease, but they can be profitable in the face of population growth and limited food supplies. The difference between raw materials for agriculture and those for livestock and meat is that the former are harvested.

- Energy: energy sources such as crude oil, gasoline, heating oil, and coal.

Oil, being a limited global supply, is subject to the volatility of its price and the willingness of the extractor to ship it. Historically, prices have fluctuated depending on demand, the state of the world economy, the Organization of the Petroleum Exporting Countries (OPEC), the transition to renewable energy sources, and major political events.

Livestock and meat: animals raised for food consumption as well as products derived from the dairy industry, poultry farming, pig farming, among others. This includes live cattle, fattening cattle, cattle, pigs, goats, poultry, eggs, milk, leather, honey, among others. Like agriculture, this sector faces many of the same constraints and benefits.

Metals: within this category are both industrial metals and precious metals. Among them are aluminum, cobalt, nickel, steel, tin, zinc. Gold, which belongs to the latter category, is one of the most stable metallic products in value. Many investors choose to invest in precious metals when stock prices are falling. Other metal commodities include silver, copper, and platinum.

Although within the definition of commodities, it is included that one of their characteristics is that they are tangible goods, technological advances have also given rise to new types of developed basic products that are exchanged in the market. There are, for example, emissions, electricity and cell phone minutes.

Types of commodity buyers

Buyer and Producers

Commodity transactions are usually carried out through futures contracts on a stock exchange that standardizes the quantity and minimum quality of the raw material that is traded.

There are two types of traders who trade commodity futures. The former are buyers and producers who use commodity futures contracts for the hedging purposes for which they were originally intended. These dealers make or take delivery of the actual commodity when the futures contract expires.

For example, the wheat farmer who plants a crop can hedge against the risk of losing money if the price of wheat falls before the crop is harvested. The farmer can sell wheat futures contracts when the crop is planted and guarantee a predetermined price for wheat at harvest time.

Commodity Speculators

The second type of commodity trader is the speculator. These are traders who trade the commodity markets for the sole purpose of profiting from volatile price movements. These traders never intend to make or receive the actual commodity when the futures contract expires.

Many of the futures markets are very liquid and have a high degree of volatility and daily range, making them very tempting markets for [intraday traders](https://www.expansion.com/economic-dictionary/trader -intraday.html#:~:text=1., return%20on%20%20capital%20invested.). Many of the index futures are used by brokers and portfolio managers to offset risk. Also, since commodities are not typically traded in conjunction with the stock and bond markets, some commodities can be used effectively to diversify an investment portfolio.

Why invest in raw materials?

Investors typically look for a commodity allocation to provide three main benefits to their portfolios: inflation protection, diversification, and return potential.

Because commodities are "real assets," they tend to react to changing economic fundamentals differently than stocks and bonds, which are "financial assets." For example, commodities are one of the few asset classes that tend to benefit from rising inflation. As the demand for goods and services increases, the price of those goods and services generally increases as well, as do the prices of the commodities used to produce those goods and services. Since commodity prices tend to rise when inflation accelerates, investing in commodities can provide portfolios with an inflation hedge.

Conversely, stocks and bonds tend to perform better when the inflation rate is stable or slowing. Faster inflation reduces the value of future cash flows paid for stocks and bonds because that future cash will be able to buy fewer goods and services than it would today.

Special Considerations

Commodity prices tend to rise when inflation accelerates, which is why investors often turn to them for protection in times of rising inflation, particularly [unexpected inflation](https://ocw.unican .es/pluginfile.php/977/course/section/1110/Principios-economia7.pdf). As the demand for goods and services increases, the price of the goods and services increases, and raw materials are what is used to produce those goods and services.

Because commodity prices often rise with inflation, this asset class can often serve as a hedge against declining purchasing power of the currency.

What determines commodity prices?

Like all assets, commodity prices are driven by the forces of supply and demand, which means a variety of factors can affect them. For example, a booming economy could lead to increased demand for oil and other energy products. The supply and demand of commodities can be affected in many ways, from political, economic and social events that can have global repercussions such as economic crises, wars, pandemics, natural disasters and the appetite of investors (investors can buy commodities premiums as a hedge against inflation if they expect inflation to rise).

Competence

The introduction of alternative technologies and goods can reduce the demand for older products. For example, the rise of renewable energy has significantly reduced investment in oil and gas.

New companies can also have a ripple effect in the market, especially those with more efficient supply chains and faster production lines, as they will lower costs and be more attractive to shareholders.

Policy

Political events and policies can cause price changes if they have an impact on exports and imports. There are different examples, but you can give an example of increases in import duties that make prices rise, trade embargoes also have repercussions.

Macroeconomics

A weak economy often reduces demand for basic products, especially those related to construction and transportation. While a booming economy may result in higher demand which could lead to higher prices.

Seasonality or seasonal variation

Agricultural commodities are particularly dependent on seasonal cycles that affect production and harvest. Prices tend to rise when harvest forecasts are positive and fall after harvest when the market is flooded with produce.

Climate

Extreme weather changes and natural disasters can affect the production and transportation of natural materials. For example, colder temperatures can freeze the ground or compromise merchandise. Anything that affects the supply chain, lowering production, can cause market prices to rise.

Sources

Hubo un error al cargar las fuentes