Map

Luis Salgado

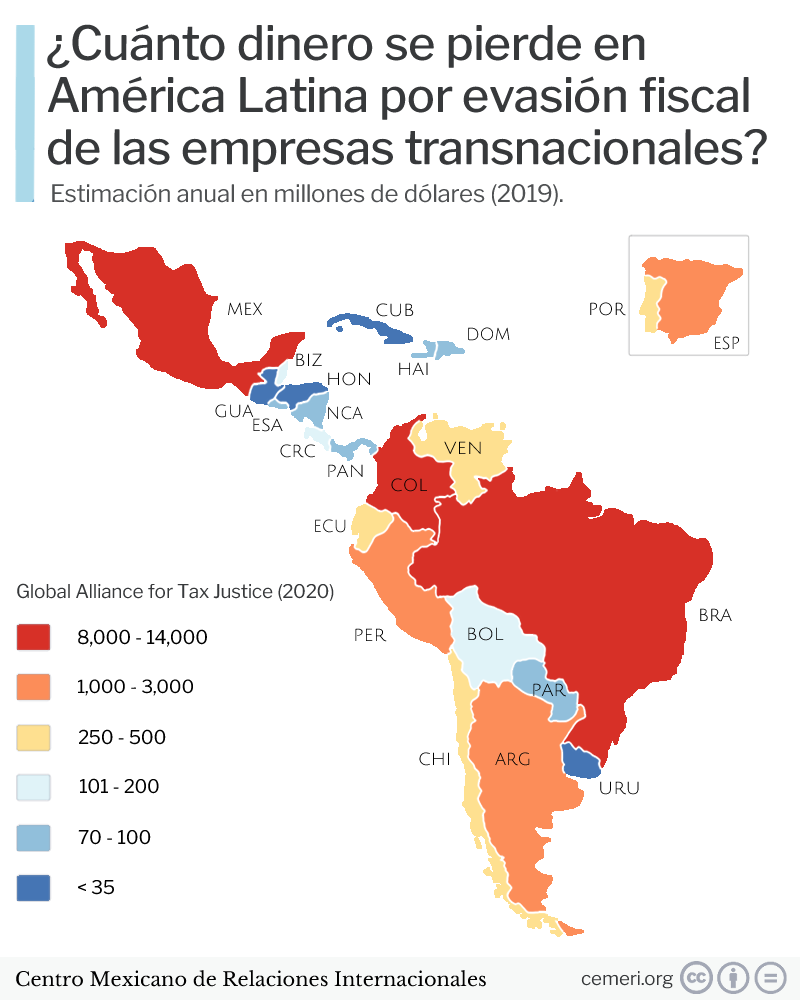

Tax evasion of transnationals in Latin America (2022)

- Mexico loses approximately $8 billion dollars in tax evasion by multinationals.

.webp?name=Tax evasion of transnationals in Latin America (2022)&format=webp&quality=55)

The State of Tax Justice 2020 reported that the world is losing more than $400 billion in taxes each year due to international tax abuse. Of that $400 billion, more than half is lost due to tax evasion practices committed by multinational corporations. They often transfer much of their profits to tax havens so they don't report how much profit they actually made in the countries where they do business and, consequently, pay less tax than they should. The other part of the more than $400 billion is lost by wealthy individuals hiding unreported assets and income abroad, beyond the reach of the law.

On average, countries around the world are losing the equivalent of 9% of their health budgets to tax havens every year, with lower-income countries losing much larger equivalent proportions than higher-income countries. For example, Mexico loses approximately $8 billion dollars in tax evasion by multinationals. This figure is equivalent to 25% of what the country spends on health each year.

In Latin America, the 3 countries with the highest losses due to tax evasion are Mexico ($8 billion USD), Colombia ($11 billion USD) and Brazil ($14 billion USD). On the other hand, the 3 States with the least evasion problems by transnationals are Cuba ($1 million USD), Uruguay ($26 million USD) and Guatemala ($31 million USD).

How do transnational corporations evade taxes in Latin America?

Although a considerable part of these losses is due to weak institutions and inefficient tax systems, there are also other reasons such as schemes and legal frameworks that lend themselves to tax evasion. An example of this is the outsourcing system that is deeply rooted in a large number of countries in Latin America, Mexico, for example.

However, tax havens are the main causes of this situation, which is not unique to Latin America. In simple words, a tax haven is a country or dependency that, due to its tax legislation, allows foreign companies to register subsidiaries in said territory and allocate a large part of their profits to them. For example, Apple could register a subsidiary in the Cayman Islands, to which it could transfer the patent for an iPhone. In this way, certain types of taxes would have to be paid in the Cayman Islands and not in the place of origin. Tax havens usually have rates of virtually 0%. That is why companies can register higher profits thanks to these schemes.

Which are the most important tax havens in the world?

In 2019, the tax havens with the most adapted tax systems for these tax evasion practices were:

- British Virgin Islands

- Bermuda

- Cayman Islands

- Netherlands

- Switzerland

- Luxembourg

- Jumper

- Singapore

- The Bahamas 10.Hong Kong

Many might be surprised to find Member States of the European Union such as the Netherlands and Luxembourg. However, what should grab your attention is the fact that 5 out of those 10 havens are UK territories and dependencies. It is estimated that the "spider web" of the United Kingdom is the cause of a third of the total evaded by transnational companies.

Sources

State of Tax Justice (2020)