Analysis

Rodrigo Vega

Europe's energy geopolitics

- The war between Russia and Ukraine has put all the countries of the European Union at a crossroads, which are entirely dependent on the supply of Russian gas to the continent.

Since Russia's invasion of Ukraine began on February 24, 2022, European countries have been engaged in a deep political debate about whether reducing their dependence on Russia for energy resources is an effective strategy to help stop the advance. of its troops and improve the region's energy security situation, that is, increase control over its energy supplies. There are those who consider the measure not only necessary, but as a duty in the face of the Russian expansionist threat, as in the case of the Baltic countries, and there are also those who proceed with more caution due to the possible consequences it could bring, as in the german case.

The truth is that, regardless of the decision taken, either by each of the countries or as a whole, energy security issues are so relevant and decisive for countries in general that periodically reassessing the configuration of energy geopolitics it becomes a necessary and fundamental task, and in particular for the European continent, derived from the current situation.

Energy security, according to the Department of National Security of Spain, refers to "State action aimed at guaranteeing the supply of energy in an environmentally and economically sustainable manner, through external supply and the generation of indigenous sources, in the framework of international commitments. This area of national security began to acquire importance in the countries' foreign policy in the 1970s, when the first world oil crisis broke out, and since then it has only increased, deepening even more with phenomena such as globalization. In general, energy security depends on various factors that each country must take into account, starting with its geographical conditions and followed by others such as demography, economy and politics, which together form the area of study known as geopolitics [ energy].

Europe's energy landscape

In this regard, there are two main issues to take into account to understand the energy landscape in Europe. In the first place, there is the so-called energy transition, the growing trend around the world to switch from using non-renewable energies, such as oil and natural gas, to renewable energies that have little impact on the environment, and of which the European continent is one of the biggest promoters, and secondly, the great dependence that the region has on external energy sources, mainly from Russia, a situation that can affect the political sovereignty of the countries (and that is evident with the crisis current).

The energy transition in Europe is largely guided by the European Green Pact, a series of initiatives promoted by the European Commission, approved by the member countries of the Union in 2020, which aims to return the continent neutral in greenhouse gas emissions. greenhouse effect by 2050, in addition to decoupling economic growth from the use of energy resources. Additionally, the purpose of the pact is to act as a strategy so that, with the investments derived from it, the economic impact of the covid-19 pandemic is more limited than expected.

By 2019, according to the European Statistical Office (Eurostat), the most important sources of energy in the European Union (EU) were petroleum products, which include crude oil, with 36%, and natural gas, with 22%. , renewable energy sources, with 15% and nuclear energy and solid fossil fuels (coal), each with 13%. With the pact, it is expected that this 15% of renewable energies will increase to 32% by 2030.

The European Commission also considers both nuclear energy and natural gas as "transitional" green energy sources, on a path to reduce the use of crude oil and coal, and make way for the use of wind, waves and tides, hydrogen and sunlight, among others. Germany, for example, is totally against this classification, and has continued with its project of completely decommissioning the country's nuclear power plants.

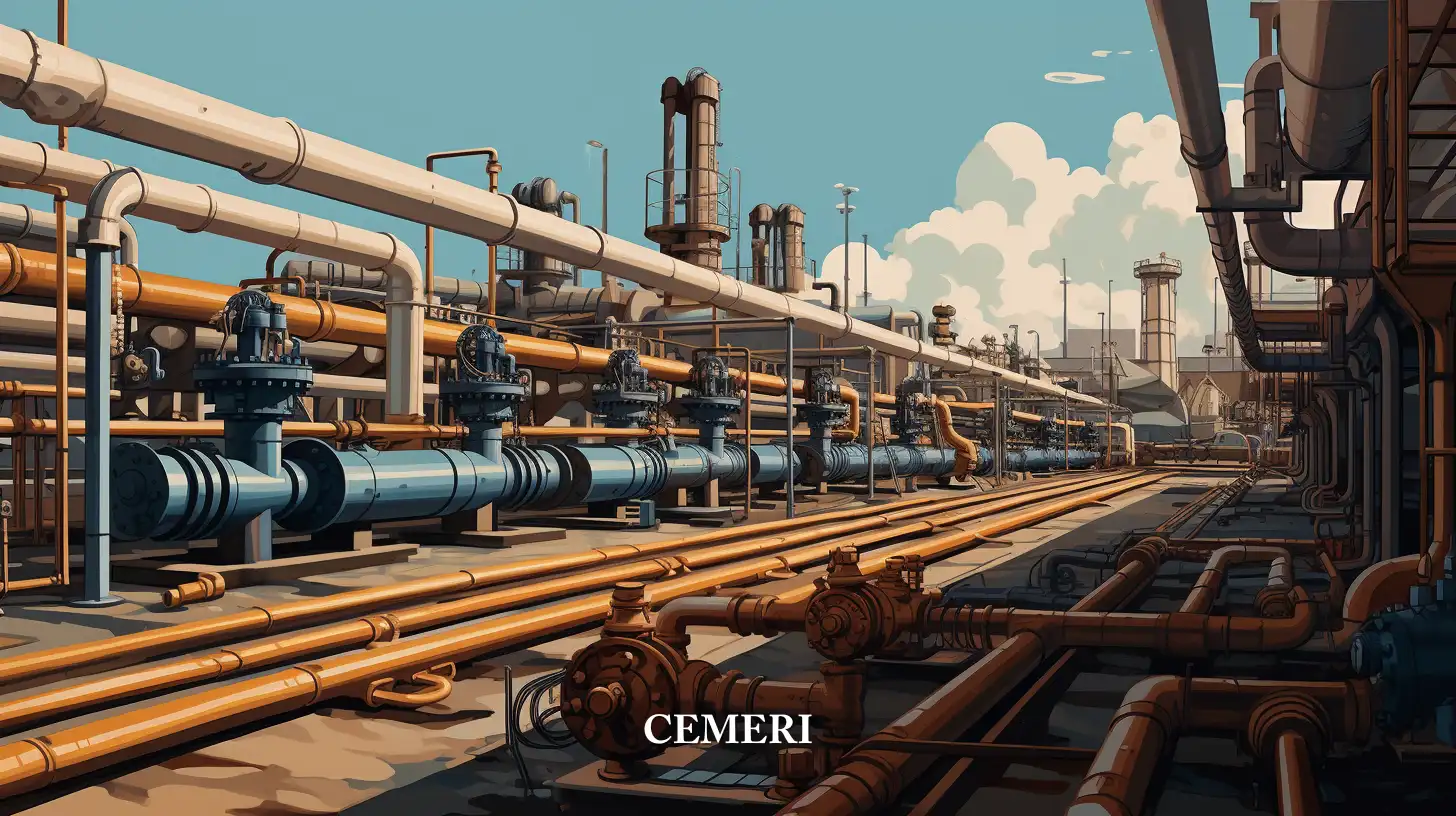

On the issue of dependency, by 2019 the EU produced 39% of its own energy, while the remaining 61% came from third countries. In petroleum products, where crude oil is included, Russia was the largest exporter to the Union, with 26.9%, followed by Iraq, Nigeria, Saudi Arabia and Kazakhstan; in natural gas, 41.1% was imported from Russia, followed by Norway, Algeria and Qatar and, finally, in solid fossil fuels, 46.7% was also imported from Russia, followed by the United States, Australia, Colombia and South Africa. In other words, most of the energy imported into the European continent comes from Russian non-renewable sources.

It should be noted that Russia is not only the EU's leading export partner in energy resources, but also ranks second in both production and exports of crude oil, which is why it is also an important trading partner for many other countries outside the European continent. .

Russia has a great diversity of natural resources, largely derived from its geographical extension with more than 17 million square kilometers, which allows it to have access to a great variety of exploitable products, highlighting of course gas and oil; according to the Russian Audit Chamber, in 2019 47.8% of the country's government revenue came from these activities. Other sectors related to the exploitation of natural resources include mining, timber production and agriculture.

Russia is also the country with the largest natural gas reserves in the world, with 48 billion cubic meters. In 2018, 52.9% of the country's total exports were crude oil and gas. Gazprom, Russia's largest company, produces around 12% of the world's natural gas, and has a monopoly on natural gas exports in the country.

On the other hand, the European continent, although it is rich in natural resources, has modest usable amounts of energy resources. The European country with the largest crude oil reserves (not counting Russia, since most of its territory is in Asia) is Norway, a country that is not part of the European Union but is part of the European Free Trade Association and, in turn, of the European Economic Area; it is also the second largest exporter of natural gas in the world. The Netherlands and the United Kingdom are also important producers of gas, mainly due to the exploitation of the subsoil of the North Sea by the British.

Europe's energy self-sufficiency, which is neither feasible nor desirable in many contexts, makes it necessary, firstly, to diversify energy sources and, secondly, to search for external suppliers. As already mentioned, most gas imports come from Russia, by sea through the Baltic Sea with the Nord Stream and the Black Sea with the Turk Stream, and by land through Ukrainian and Belarusian territory.

The trans-Anatolian gas pipeline runs from east to west through Turkish territory and transports gas from Azerbaijan, connecting with the trans-Adriatic gas pipeline through Albania and Greece, and Algeria and Tunisia do the same through the Mediterranean Sea and the territory of countries such as Morocco. There is also a large amount of liquefied natural gas that reaches the various ports.

The invasion of Ukraine

This whole issue has become relevant in recent years, particularly since the annexation of Crimea in 2014. Recently, with the invasion of Ukraine that began in February 2022, this issue has come to the top of the priorities of European leaders.

Since the conflict formally began, one of the most analyzed strategies to face the crisis has been precisely that of limiting or definitively ending the energy agreements between the region and Russia, and the first proof of this was the decision of the German Chancellor, Olaf Scholz, to suspend the certification of the Nord Stream 2 infrastructure project, a gas pipeline owned by Gazprom that originates in the city of Viborg, at the Russian outlet to the Baltic Sea, and ends in the city of Greifswald, in northeast Germany, that prevented its implementation; days later the construction company -of the same name as the project- declared bankruptcy.

The suspension occurred two days before the invasion, on February 22, as part of the first sanctions against Russia for having recognized the independence of the self-proclaimed republics of Donbas. The move was celebrated but also questioned as a key strategy that analysts say could have been used with more caution.

Thereafter, and after the so-called Bucha Massacre, an alleged massacre of hundreds of civilians by the Russian army north of Kiev, the European Union agreed to a total ban on imports of Russian coal, and Lithuania became the the first country from that organization to announce that it would stop importing 100% of the gas from Russia in the coming months, followed by Estonia and Latvia. Other countries such as Finland and Poland have also urged the rest of the region's leaders and the European Commission to speed up Russia's energy independence plans.

On the other hand, Germany, the largest importer of Russian gas, has opted for a much more cautious approach to the issue, finding divided opinions in the coalition government led by Chancellor Scholz. Foreign Minister Annalena Baerbock declared that the country would end dependency by the end of the year, while Finance Minister Christian Linder declared days later that while the goal is to end dependency, it would take a long time. .

A notable exception to the consensus is Hungary, as re-elected Prime Minister Viktor Orban, a partner of Vladimir Putin, declared on April 6 that his country would have no problem paying for gas in rubles, Russia's currency, after said country so required days before. Hungary is the EU country that imports the most Russian gas in proportion to its energy consumption.

Outside the Union, the United Kingdom has also decided to end the importation of Russian gas by the end of 2022; For its part, Norway has committed to increasing its production to support supplies on the continent. Serbia, another Russian partner, will begin negotiations with Gazprom for a new 10-year agreement.

It is also worth noting the importance of the North Atlantic Treaty Organization (NATO) for energy security in the region. NATO, to which 27 European countries belong, in addition to the United States, Canada and Turkey, has a plan, agreed in 2010, with three objectives in terms of energy security: improve members' understanding of the relationship between security and energy, increase the protection of countries' key energy infrastructure and, finally, promote energy efficiency in the military sector. Since 2012, the organization has had an Energy Security Center of Excellence located in Vilnius, the Lithuanian capital.

What's next in Europe's energy geopolitics?

With the Russian invasion of Ukraine, the region's joint response, materialized in the European Union, is aimed at reducing energy dependence on Russia by ⅔. The RePowerEU is how the plan to achieve this will be known and consists of various steps, including expanding the gas storage capacity of member countries, increasing biomethane production to double the objective established by the European Green Pact for 2030 and investing in make European households more efficient, among other measures.

Additionally, energy cooperation will be increased with other countries that supply natural gas, such as Algeria through the Mediterranean and Azerbaijan with the trans-Anatolian gas pipeline, as well as with transit countries for the gas pipelines, such as Albania, Georgia and Turkey. The United States, for its part, has already increased its exports of liquefied natural gas to Europe, going from 34% of the total in 2021 to 75% currently, and it is intended to reach agreements of the same type with countries such as Egypt, Israel or Qatar.

On the other hand, the European Green Pact, proposed long before the conflict in Ukraine, will function as a catalyst to promote the reduction of dependency, according to what was mentioned by the majority of the environment ministers of the member countries during the meeting of the Council of the EU of March 17, 2022, of course motivated by the general opposition to the invasion.

It should be noted that limiting the use of coal as an energy source is part of the objectives of the Pact, however, with the conflict in Ukraine and the decision of European leaders to prioritize energy independence towards Russia, this may be compromised due to the urgency to seek alternative sources, according to various analysts.

In general, the guarantee of energy supply is a matter of national security for practically all countries in the world. With globalization and new technologies, as well as the growing importance of environmental issues, there has been a need to find new sources of energy, make existing ones more efficient and ensure the operation of international alliances and agreements, becoming a primary issue. of foreign policy.

Europe has historically relied on imported raw materials and products to run its industry, and energy resources are no exception. Dependence on oil and gas from Russia and other regions has been a topic of debate for years and it was not until the invasion of Ukraine in February 2022 when it really became a priority, showing the ability of European countries to speak in unison on issues of regional security such as a war, although in the specifics there are great disagreements and nuances and there are exceptions, such as the Hungarian case.

The energy approach, with this turning point in European political history, will have to be expanded towards the diversification of sources and suppliers that offer greater security and have less political cost, not without continuing with the green policies of the Pact and with the strategies to face the challenges that were already known, including the covid-19 pandemic.

Energy dependence is a highly controversial and politicizable issue globally and in all countries, and the European situation could become a textbook example of how to handle the challenges of energy sovereignty, how to influence geopolitics and even how to prevent them from A similar point is reached, depending on the decisions that are made in the following months and years.

Sources

Bartuška, V., Lang, P., Nosko, A. (2019). The Geopolitics of Energy Security in Europe. Recuperado de: https://carnegieeurope.eu/2019/11/28/geopolitics-of-energy-security-in-europe-pub-80423

Buli, N., Adomaitis, N. (2022). Norway to supply more gas to Europe this summer. Recuperado de: https://www.reuters.com/business/energy/norways-equinor-raise-gas-output-major-fields-2022-03-16/

Clifford, C. (2022). How the EU plans to cut dependence on Russian gas by two-thirds this year. Recuperado de: https://www.cnbc.com/2022/03/08/how-the-eu-plans-to-cut-dependence-on-russian-gas-by-67percent-this-year.html

Cohen, A. (2022). Putin’s War in Ukraine Forces New Energy Reality on Europe. Recuperado de: https://www.forbes.com/sites/arielcohen/2022/03/28/putins-war-in-ukraine-forces-new-energy-reality-on-europe/?sh=4b0c9fe1393c

Comisión Europea. (s/f). Un Pacto Verde Europeo. Recuperado de: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_es

Departamento de Seguridad Nacional. (s/f). Seguridad Energética. Recuperado de: https://www.dsn.gob.es/es/sistema-seguridad-nacional/qu%C3%A9-es-seguridad-nacional/%C3%A1mbitos-seguridad-nacional/seguridad-energ%C3%A9tica

Deutsche Welle. (2018). Turkey opens TANAP pipeline that will bring Azeri gas to Europe. Recuperado de: https://www.dw.com/en/turkey-opens-tanap-pipeline-that-will-bring-azeri-gas-to-europe/a-44192422

Dodman, B. (2022). Baltic states end Russian gas imports – but can the rest of Europe follow suit? Recuperado de: https://www.france24.com/en/business/20220405-baltic-states-end-russian-gas-imports-%E2%80%93-but-can-the-rest-of-europe-follow-suit

EFE. (2022). La constructora del gasoducto Nord Stream 2 se declara en quiebra. Recuperado de: https://elpais.com/economia/2022-03-02/la-constructora-del-gasoducto-nord-stream-2-se-declara-en-quiebra.html

European Commission. (s/f). Diversification of gas supply sources and routes. Recuperado de: https://energy.ec.europa.eu/topics/energy-security/diversification-gas-supply-sources-and-routes_en

European Commission. (2022). REPowerEU: Joint European action for more affordable, secure and sustainable energy. Recuperado de: https://ec.europa.eu/commission/presscorner/detail/en/ip_22_1511

European Commission. (s/f). Renewable energy targets. Recuperado de: https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en

European Environment Agency. (2013). Priority resources by a broad category. Recuperado de: https://www.eea.europa.eu/ds_resolveuid/ONJGGBDRDB

Eurostat. (2019). From where do we import energy? Recuperado de: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html?lang=en#carouselControls?lang=en

Geohistory. (2019). A Guide to Russia’s Resources. Recuperado de: https://geohistory.today/resource-extraction-export-russia/

Government Communication Unit. Estonian government decides to cease imports of Russian gas. Recuperado de: https://www.valitsus.ee/en/news/estonian-government-decides-cease-imports-russian-gas

Islam, F. (2022). Germany rules out immediate end to Russian oil imports. Recuperado de: https://www.bbc.com/news/business-61164894

Kollewe, J., Mason, R., Stewart, H. (2022). UK to phase out Russian oil imports by 2023 and explore ending gas imports. Recuperado de: https://www.theguardian.com/world/2022/mar/08/no-10-plans-cut-russian-fossil-fuels-use

Kurasinska, L. (2022). While The World Boycotts Russia, Serbia Moves To Clinch A New Gas Deal With Gazprom. Recuperado de: https://www.forbes.com/sites/lidiakurasinska/2022/03/22/while-the-world-boycotts-russia-serbia-moves-to-clinch-a-new-gas-deal-with-gazprom/?sh=5a948c6914a8

Kurmayer, N. (2022). Germany rules out prolonging its nuclear power plants. Recuperado de: https://www.euractiv.com/section/energy/news/germany-rules-out-prolonging-its-nuclear-power-plants/

National Geographic. (2012). Europe: Resources. Recuperado de: https://www.nationalgeographic.org/encyclopedia/europe-resources/

Reuters Staff. (2020). Russia begins TurkStream gas flows to Greece, North Macedonia. Recuperado de: https://www.reuters.com/article/us-russia-bulgaria-gas/russian-begins-turkstream-gas-flows-to-greece-north-macedonia-idUSKBN1Z40D0

Sevillano, E. (2022). Alemania suspende la certificación del polémico gasoducto Nord Stream 2 tras la escalada en Ucrania. Recuperado de: https://elpais.com/internacional/2022-02-22/alemania-suspende-la-certificacion-del-polemico-gasoducto-nord-stream-2-tras-la-escalada-en-ucrania.html

Statista. (2022). Ranking mundial de los principales países productores de petróleo en 2021. Recuperado de: https://es.statista.com/estadisticas/634780/paises-lideres-en-la-produccion-de-petroleo/

Strauss, M. (2022). European Commission declares nuclear and gas to be green. Recuperado de: https://www.dw.com/en/european-commission-declares-nuclear-and-gas-to-be-green/a-60614990

Taylor, K. (2022). Europeans rally behind Green Deal in response to Russia’s war in Ukraine. Recuperado de: https://www.euractiv.com/section/energy/news/europeans-rally-behind-green-deal-in-response-to-russias-war-in-ukraine/

The Associated Press. (2022). Europe agrees to ban Russian coal, but struggles on oil, gas. Recuperado de: https://abcnews.go.com/Politics/wireStory/europe-set-ban-russian-coal-struggles-oil-gas-83930012

Udasin, S. (2022). These European countries are the most dependent on Russian gas. Recuperado de: https://thehill.com/policy/equilibrium-sustainability/3260553-these-european-countries-are-the-most-dependent-on-russian-gas/

Ukrainian Think Tanks Liaison Office in Brussels. (s/f). Commercial Makeup of Geopolitical Projects: How Russia Builds Infrastructure to Re-route Transit of Natural Gas via Ukraine. Recuperado de: https://ukraine-office.eu/en/commercial-makeup-of-geopolitical-projects-how-russia-builds-infrastructure-to-re-route-transit-of-natural-gas-via-ukraine/